Whether you are an entrepreneur, a freelancer or managing household expenses, accounting is that financial record-keeping backbone that is a must for success in business or personal finance. It allows you to make valid choices, avert financial traps, and comply with tax requirements.

In this write-up, we’ll break down the key essentials of this important subject; its importance and how, being a non-accountant, you may also handle your records effectively.

What Is Accounting and Why Does It Matter?

Accounting is the systematic recording, tabulation, and analysis of financial transactions. It enables businesses and individuals to keep an eye on income, expenses, assets, and liabilities, thus promoting financial stability and transparency.

Without proper accounting, businesses are prone to cash flow crises, tax citations, and incompetence in financial planning. This will cause difficulty in all future financial planning.

Main Forms of Accounting

1. Financial Accounting

Entails the provision of financial statements for external stakeholders like investors, banks, and regulators.

2. Managerial Accounting

Intended to give business owners and managers financial data which to formulate strategic business decisions like budgeting, cost analysis, and financial forecasting.

3. Tax Accounting

Keeps checks for compliance with tax laws; computes taxable income, files income tax returns, and organizes deductions.

4. Bookkeeping

The basics of accounting involves recording daily financial transactions, including sales, purchases, payrolls, and cost data.

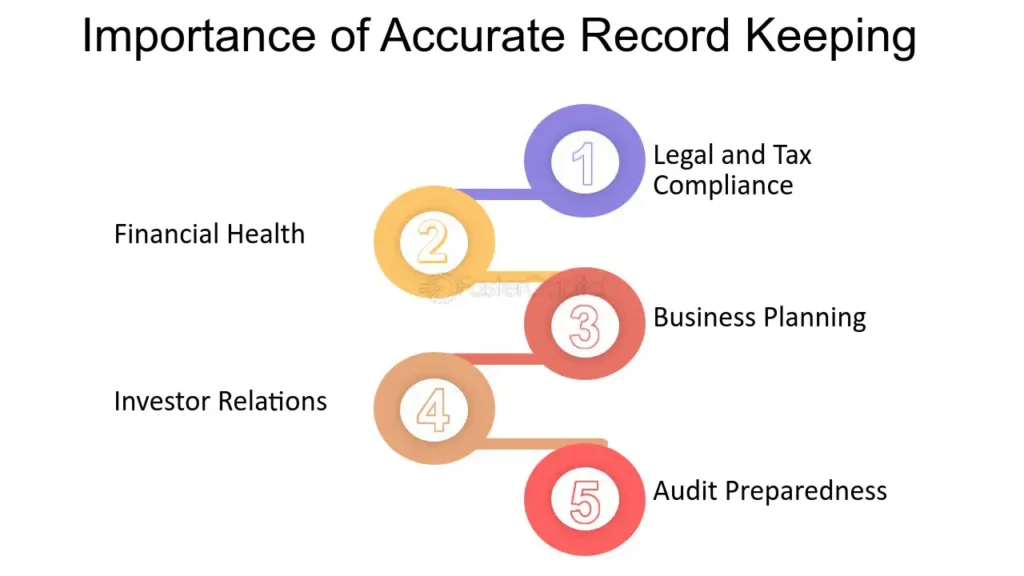

Importance of Financial Record Keeping

✔ Keeps track of income & expenses. This enables one to monitor funds-in-flow and out-flow.

✔ Ensures legal compliance. It keeps your business liable for tax rules and audits.

✔ Facilitates sound decision-making. It provides accurate financial information for budgeting and investment purposes.

✔ Helpful in shortlisting loans and investments. A detailed financial track improves credibility with banks and investors.

✔ Prevention of fraud & errors. Builds in a mechanism to detect discrepancies and forestall such happenings.

Essential Accounting Practices for Businesses and Individuals

1. Keep Proper Records of Accounts

Keep all the receipts, invoices, and bank statements organized.

Use accounting software like QuickBooks, Xero, or Excel to track monthly incomes and expenses.

2. Double-Entry System

Every transaction should have debit and credit to maintain accuracy.

3. Get Started With Financial Statements

Balance Sheet: The balance sheet shows the assets related to liabilities and equity at a point in time.

Income Statement: Shows revenue, expenses, and profit/loss through a period.

Cash Flow Statement: To be maintained to analyze the cash coming in and cash going out.

4. Keep Personal Finance and Business Finance Separate

Open an exclusive business bank account that serves the purpose and avoids the financial mess.

5. Set up a budget and closely monitor cash flow

Having proper budgeting helps trace the outflow, hence financial stability each month.

Keep a keen eye on cash flow analysis to avoid over expenditure and liquidity hose.

6. Keep Track of Tax Payments

Stay up to date on your records of the deductible expenses that will minimize your taxation.

Filing your tax return on time to avoid interests and penalties.

7. Hire a Paid Accountant on Demand

When the finances overcome their owner, they may find hiring the accountant or bookkeeper is time-saving with statutory compliance.

Tools and Software for Efficient Accounting

✅ QuickBooks: For small businesses and freelancers.

✅ Xero: Cloud-based accounting, automation features.

✅ FreshBooks: Great for invoicing and tracking expenses.

✅ Wave Accounting: A free tool for startups and small businesses.

✅ Microsoft Excel: For the establishment of financial spreadsheets and reports.

Common Accounting Blunders to Avoid

❌ Failing to Track Yours Small Expenses: Even small expenses add up and affect cash flow.

❌ Mixing Personal with Business Accounts: This can make it difficult to file taxes and create tax problems and legal issues.

❌ Ignoring Deadlines: This will create penalties and interest charges.

❌ Ignoring Bank Reconciliation: This may go undetected as an error or fraud.

❌ Ignoring Cash Flow Management: Cash is king; businesses fail due to cash shortages, not cash profits.

Bottom Line

Accounting is more than just numbers: Essentially it also refers to ones’ financial control, planning, and success. Proper financial record-keeping goes a long way to ensuring that you will end up healthy financially, make informed decisions, and avoid costly mistakes.

By observing sound record-keeping practices and adopting the right financial tools, businesses can secure their finance and pave the way toward attaining lasting stability.

Are you book keeping well now? Get onto it and secure your financial future!