For much of the history of humanity, economic problems like the current crisis have recurred, impacting adversely on individuals, businesses, and governments each time they have arisen. Economic cycles of boom and bust may be normal, but the crisis often clearly reminds the world not to be complacent in regard to vulnerabilities in the international financial system. The article dives deep into international economic crises, exploring their nature, causes, past experiences, and what needs to be done to lessen their negative effects.

What is a Global Economic Crisis?

A global economic crisis is thus mainly defined as a very pronounced slowdown in global economic activity which affects many countries simultaneously. Such a crisis generally shows signs of a declining GDP, rising unemployment rate, declining volume of trade between countries, and instability in the financial market. Most international economic crisis situations know moments of acute pain and give rise to hardship that extends to millions of people, especially in lower socio-economic groups.

The Aftermath of a Global Economic Crisis

1. Unemployment Spike

As business crumble left and right, layoffs get into full swing, and millions of layoffs hit ordinary folk right in their pockets.

2. Financial Market Collapse

Stock markets crash during crises, with trillions of investments disappearing overnight. The result is lost consumer confidence as the wealth of retirees and investors vanishes.

3. Decline in Global Trade

Global trade often suffers as crises ensue from the disruption of global supply chains, raising prices and causing shortages of essential commodities.

4. Increase in Public Debt

Governments launch various stimulus packages during a crisis as a reactive measure, causing the public debt level to reach new heights. While this helps in rebooting the economy, it leads to future fiscal consolidation struggles.

5. Increased Political Instability

By feeding into the cycle of economic despair, one effect is often a rise in political unrest. Protests flare up against leaders because they compete with other countries for dwindling natural resources.

6. Inflation and Recession

Many crises cause depreciation or deflation, which makes it harder for households to afford very basics. This triggers economic recession and thereafter has placed extra financial burden on common citizens.

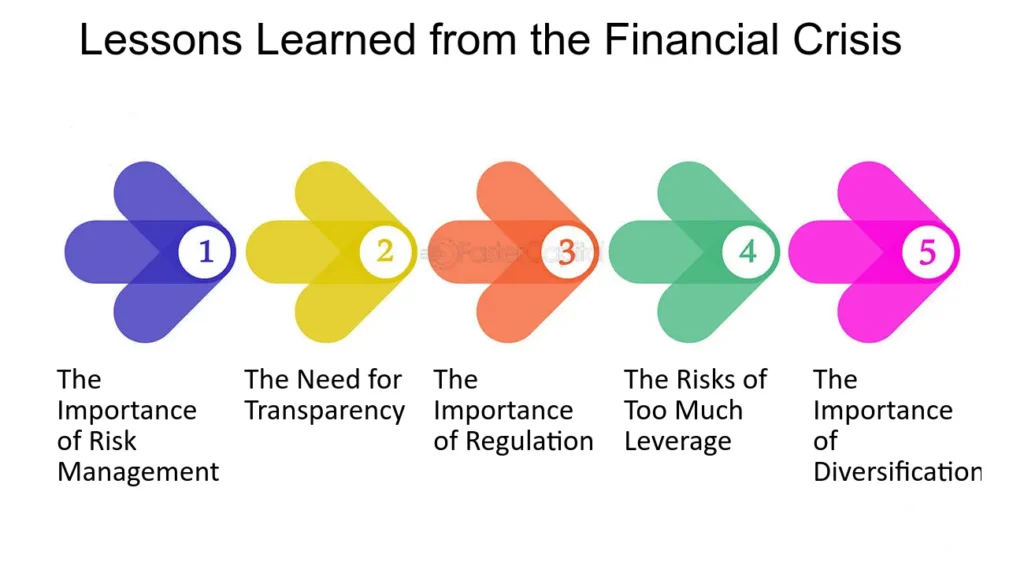

Lessons Learned from Previous Global Economic Crises

1. The Great Depression (1929-1939)

Cause: Stock Market Crash, Overproduction of Goods, Bank Failures.

Effect: An estimated 25 percent of the U.S. workforce was unemployed, and world trade collapsed.

Lesson: It showed how significant market regulation was in avoiding bubbles in speculative markets.

2. The Financial Crisis of 2008

Cause: Collapse of the housing market, predatory financial products, high leverage with banks.

Effect: Millions lost their homes and jobs, a $2 trillion bailout package was required to restore economic stability.

Lesson: There need to be enhanced risk management frameworks and disclosure procedures in financial institutions.

3. Economic Shock from the COVID-19 Pandemic (2020).

Cause: Lockdowns imposed due to a pandemic, disrupted supply chains, and lowered consumer spending.

Effect: A 3.5% decline in GDP globally, millions of businesses shutting down for good.

Lesson: Supply chain diversification is crucial, as is a quick response from the government.

Causes of Global Economic Crisis

1. Unsustainable Debt Levels

Often, high levels of debt—by individuals, corporations, or governments—lead to some level of financial instability whenever debts cannot be repaid.

2. Speculative Bubbles

Surprise bursts of asset bubbles, such as a real estate or stock bubble, ruin many investors financially.

3. Geopolitical Tensions

The ultimate breakdown of international commerce and the creation of uncertainty disrupting the economic cycle could follow wars, trade disputes, and the imposition of sanctions.

4. Natural Disaster and Pandemics

An abrupt natural catastrophe or health crisis may force the economy to shutdown, as seen during COVID-19.

5. Lack of Regulation

Under-regulated financial systems tolerate risky behavior that has the potential to lead to economic collapse.

Measures to counteract Global Economic Crises

Measures to counteract Global Economic Crises

1. Prioritize Financial Rule-making

Merely governments need to impose stricter restrictions against banks and financial institutions to discourage them from indulging in business practices involving high risks such as excessive leveraging and high stakes trading.

2. Diversify the Economy

Countries are called upon to invest in different sectors rather than to depend heavily on a single sector, which will assist them in strengthening resistance to onslaughts against any other sector.

3. Build Support Via International Cooperation

Global crises should attract a more-than-sufficient global solution. Countries could come together through organizations such as the IMF or the World Bank to jointly deal with the crisis.

4. Be Financially Literate

Teaching individuals about saving, investment, and risk might serve to reduce the risk of an individual or corporate mismanagement of personal finances in the time of any crisis.

5. Invest in a Green Future

In attending to environmental protection and sustainable economies, one is able to check crises arising from resource depletion and climate change.

6. Stimulus by Packages and Safety Nets

Governments must build desire into a position where sound stimulus programs are in place as a timely move to allow people and enterprises wrestle through crisis times with some government support.

7. Invest in Technology and Innovation

Innovation creates industries and jobs hence serving as a safety valve when the economy gets clogged up.

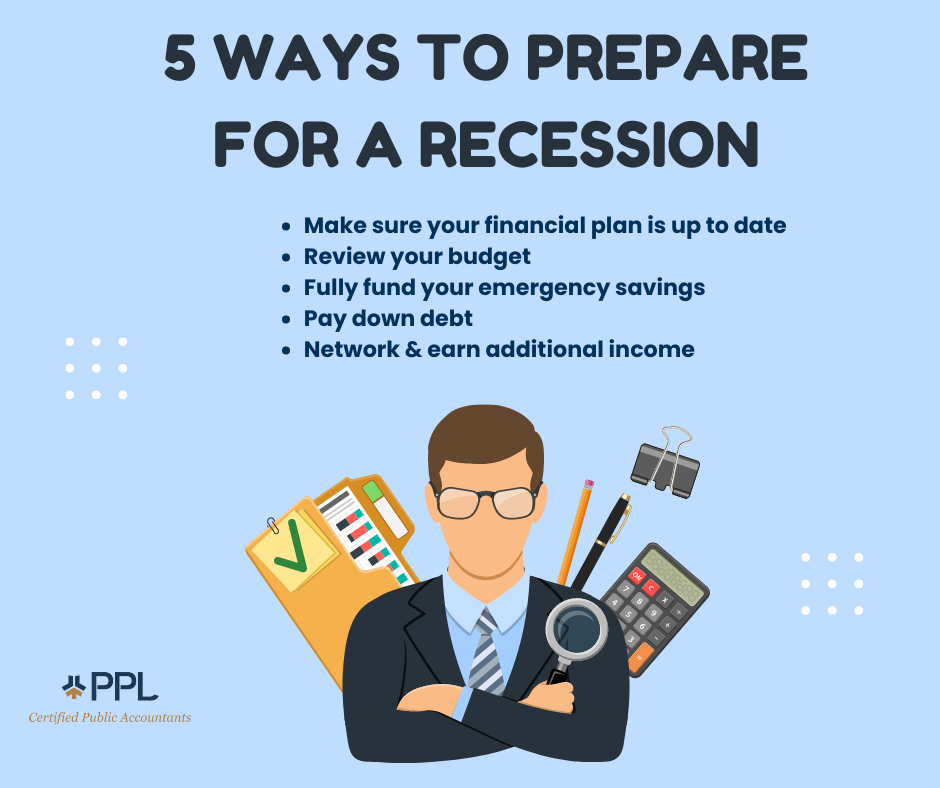

How Individuals Can Prepare for Economic Crises

- 1. Build an Emergency Fund

In this regard, an emergency fund should ideally entail saving between 3 and 6 months of expenses for cushioning effects.2. Sources of Income

You’re not going to be reliant on a single income; there might be side-hustles or passive income streams down the road.3. Resolve Debt

To prevent problems in the economy, pay off high-interest debt beforehand.4. Invest Phased-out and Recorded

Choose diversified low-risk investments that can outlive economic uncertainty through time.5. Be informed

Tracking the global economy can give you foresight into the future of any crisis and can help you plan.

Final Thought

While there do appear to be unavoidable periods of financial crises, the impact of these crises must be minimized through preparedness, education, and collaboration. Any lessons learned from the past, combined with proactive strategies, will surely enable people, organizations, and governments to deal with possible crises with far greater resilience.

Every crisis is an opportunity to build back bigger and better. Get up in the now and do something for tomorrow!