Introduction

Most people are scared of budgeting; however, the 50/30/20 rule provides a simple solution. This guide will walk you through how you can utilize this rule to its maximum potential in prioritizing expenditure and savings. By the end of the guide, you will know why this budgeting technique is popular amongst the serious financial crowd.

1. What Is 50/30/20 Rule, and Why Does It Work?

Keywords: 50/30/20 rule, budgeting basics, financial planning, effective budgeting

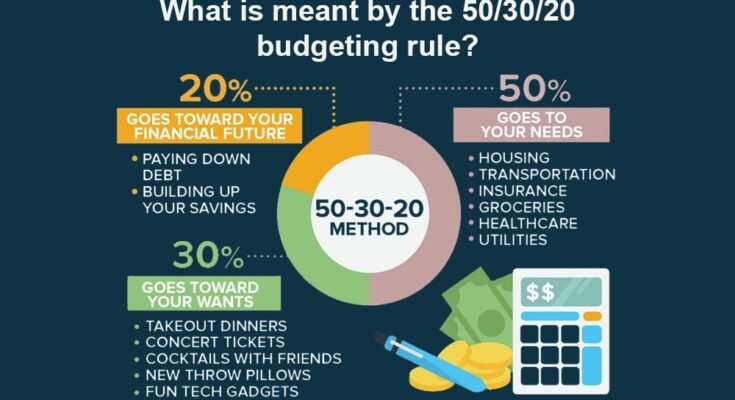

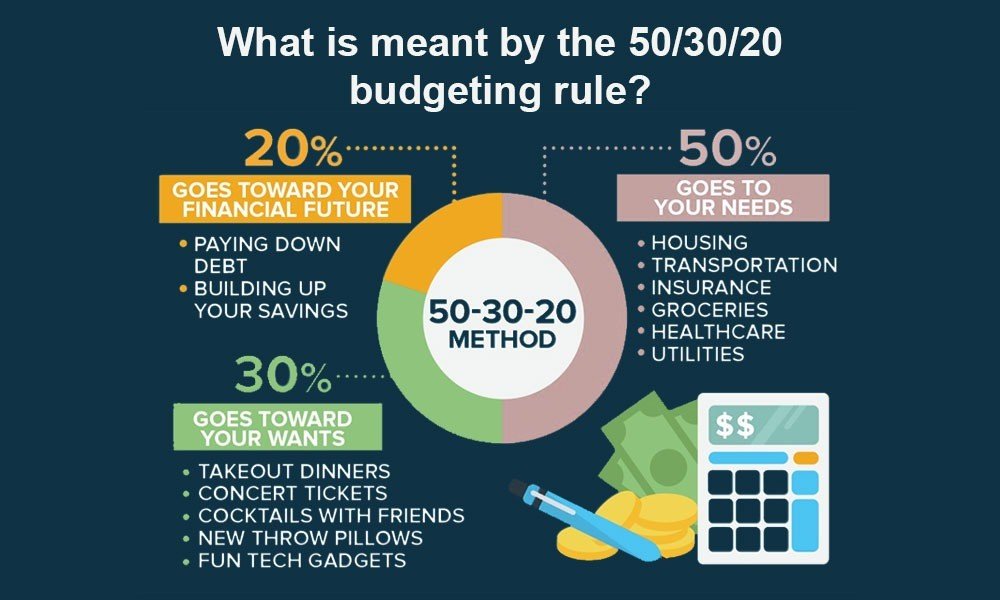

The 50/30/20 rule divides income into three categories: essentials, personal expenses, and savings and debt repayment. Each category receives 50%, 30%, and 20%, respectively. This approach allows us to manage our finances as flexibly and enjoyably as we can.

Why It Works

Overly rigid structure: These categories are fairly neat and allow a clear view of where you supposed to be spending your money. So, whatever else needs to be re-calibrated, it would be easy for you to do that.

Balance: This rule allows some room for personal spending, thus decreasing the feeling of restriction that comes with some budgeting methods.

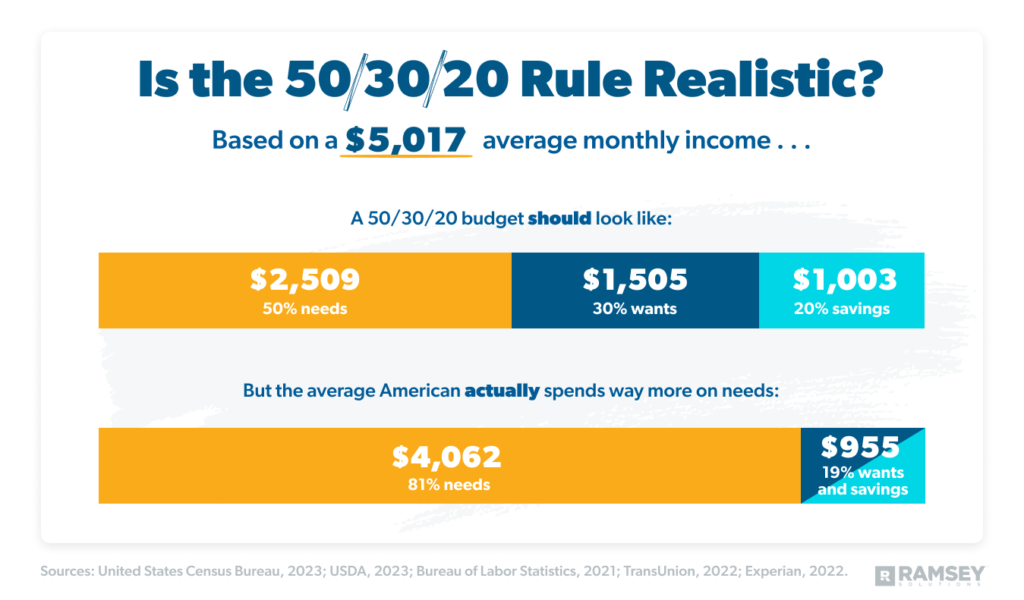

Scalability: The 50/30/20 rule can be applied to any income, making it accessible to a vast array of people.

2. The Beat-by-Beat Instructions: How to Get Started on Budgeting the 50/30/20 Way

The Automagical Budgeting Guide: How to Budget 50/30/20 Setup

Setting a 50/30/20 budget is simple and easy as pie:

Find your after-tax income. This will be your monthly after-tax income, which is a basis for your actual budget.

Assign 50% for necessities. Include expenses that provide a base for regular living, for example, rent, utilities, food, car bills, and insurance.

Set aside 30% of the income for Personal Expenses. This is money to spend for enjoyment, dining out, entertainment, shopping, and wants.

Save 20% on Financial Goals like saving, investing, and paying down debts.

Quick Breakdown:

So a $3,000 a month income would look like this:

$1,500 for essentials,

$900 for personal expenses,

$600 for savings and debt repayment.

This gives you a comprehensive budget covering needs, enjoyment, and growing finances.

3. Advanced tricks to Make the Best of the 50/30/20 Rule

Keywords: budgeting tips, tips on increasing savings, 50/30/20 budgeting hacks

To make your 50/30/20 budget work to your benefit, these tips could help:

Consider automating savings. That way, 20% will go automatically towards your goals.

Check in and readjust each month. Come up with new methods of prioritizing a specific living cost with going off your budget if a life change occurs or other expenses appear unexpectedly.

Utilize budgeting apps. Apps such as Mint, YNAB, and Personal Capital can help you track your expenditures effectively while keeping you under budget to 50/30/20.

Focus on debt reduction. If you happen to have large debts, making adjustments to prioritize getting above 20% toward paying them off may help, even if it means dialing back on personal spending for a while.

4. How the 50/30/20 Rule Builds Long-Term Financial Health

Keywords: benefits, long-term budget; financial health; smart money management

The 50/30/20 rule is more than about short-term budgeting; it will put you in line for a more secure financial future. Here are such benefits:

Steady Growth of Savings: Automatic allocation of 20 percent to savings develops financial readiness to stably mature, in turn.

Low Financial Stress The 50/30/20 rule can lower financial anxiety and promote healthier spending habits by ensuring that essentials are always accounted for.

Encouragement of Intelligent Spending Decisions: Having 30 percent of one’s income reserved for personal spending allows for enjoyable spending without guilt, leading to more thoughtful purchases, as will provide for annual vacations, an entertainment budget, etc.

Leads to Debt-Free Life: With a discretionary repayment being used toward debt, lending gets paid more rapidly, leading to financial independence.

Conclusion

The 50/30/20 rule is a balanced, flexible marriage of budgeting into long-term financial health. With this budget in place, you can adopt advanced methods to work on your finances while moving towards your financial freedom.