In 2025, are you ready to take control of your financial future? Whether you’re a veteran in investing or a complete novice, your journey of riches will involve taking small steps on purpose. But how to start investing smart and successfully? Let’s get into powerful strategies, expert insights, and actionable tips on starting your financial growth this year.

Why Start Investing Now?

Investing is instrumental to financial independence, allowing wealth to build beyond traditional savings. Small investments can compound to yield substantial gains over time. Starting in 2025 means you’ll be cashing in on current trends and opportunities within the market to ensure your future success.

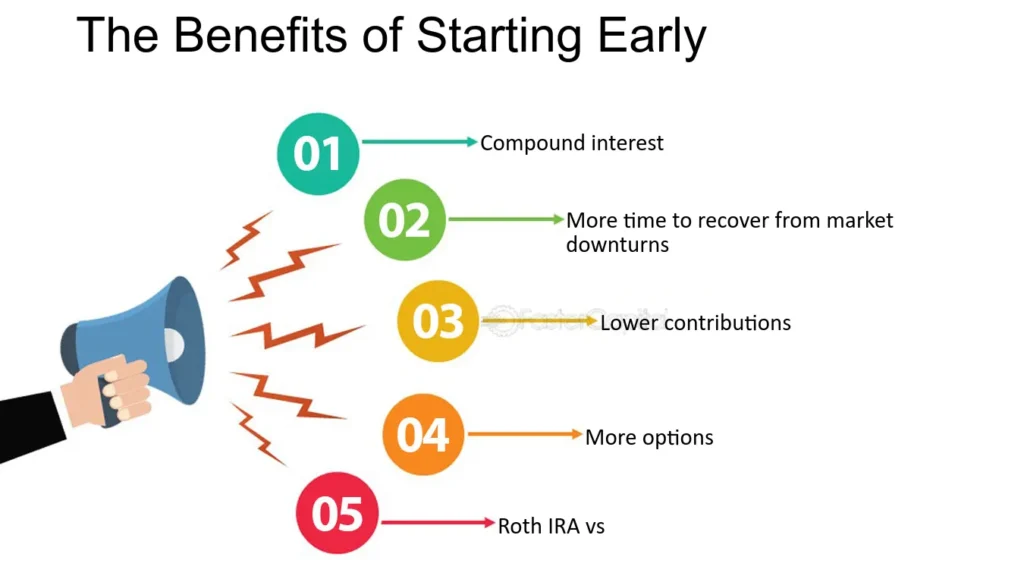

Benefits of Starting Early

Home Advantage: The sooner you invest, the more that money is bound to grow.

Peace of Mind: An investment portfolio is built to help secure uncertain – but needed – financial assets in the future.

Wealth Building: Intelligent investing will enable you to reach some financial goals – whether to buy a home, send your children to college, or retire comfortably.

Best Investment Strategies for 2025

1. Consider Low-Cost Index Funds

These are probably the best places for beginners to start. They charge low fees and offer a diversified portfolio, tracking most of the large stock indices and showing relatively stable performance over the long haul.

2. Invest in Dividend Stocks

Dividend stocks will not only furnish you with a check, but they will also help you grow your capital. Seek reliable companies that have paid their dividends consistently.

3. Invest in Real Estate

Real estate investing remains a very profitable touch. Options include buying property outright, investing in real estate investment trusts (REITs), or even crowdfunding options.

4. Use Robo-Advisors

Confused about how to start? Robo-advisors are like a special algorithm service that picks great investment options from your portfolio. This will depend on your risk tolerance and financial goals, bringing investing to everyone.

5. Diversification of Portfolio

Have a diversified portfolio in which you don’t put all your eggs into one basket. Spread it out between different asset classes stocks bonds real estate and alternative assets like cryptocurrencies.

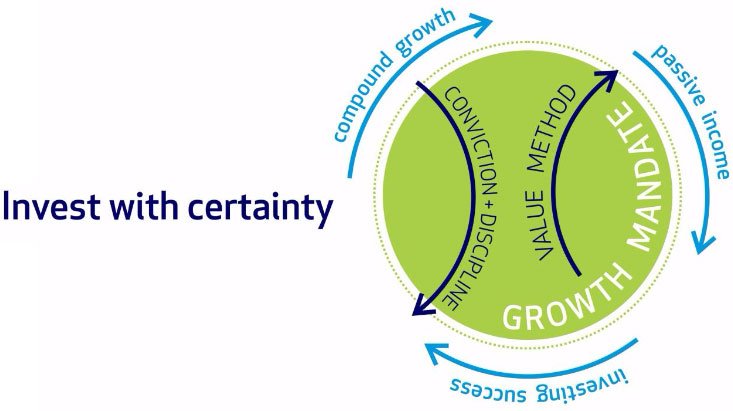

How to Begin Investing with Certainty

Set Clear Goals

Clear Goals for Investment What is it you’re trying to achieve? Saving for retirement buying a house or establishing an emergency fund? You can use viable goals to guide you in your investment choices.

Know Your Risk Appetite/scope

Realize how comfortable you are with dealing with market fluctuations. Young investors can afford to be thus higher risk while those nearing retirement may have a more conservative strategy.

Start Small

There is no obligation to put all your wealth on stake many platforms allow you to begin investing with as little as $50.

Educate Yourself

Knowledge is power. Read up on books, follow finance blogs and keep current with market trends, which will foster better decision-making.

Some Hot Topics in 2025

1. Green investment: This does feel attractive. Companies involved with clean energy, climate tech, and ESG have become favorites in an investor’s list.

2. Cryptocurrency innovation: Cryptos are, although volatile, broadening their scope. They are expected to give the bold investor stablecoin and blockchain-driven activity.

3. AI and Tech Stocks: Technology is, in this case, still a market of active and rapid growth. AI, robotics, or innovation-based crude firms are expected to take up spot markets this year.

Life-changing Experiences

Emma’s journey toward financial independence: Five years back, Emma charged $100 against her index fund every month. Her portfolio is now much bigger, providing her with even more confidence to aim higher-her very own home.

A Steady Income Stream for James

Through dividend stocks and REITs, James now generates passive income that gives a nice boost to his main source of income and funds his travels as well.

Some Great Mistakes to Avoid

Fugue congerty: It is always importantly destructive to omit research in order to minimize investment opportunities.

Making Decision Upon Emotions: The knee-jerk reaction is likely to lead to decision-making during the volatile phases of every sinking market.

Neglecting Little Things, Like Fees: The higher the fees, the more they eat into your profits. Keep all options to a minimum instead.

A Plan of Action: Start Investing in 2025

Choose a Channel: Create a brokerage account or an online app.

Budget Set Yourself: Decide the amount that you will invest each month without affecting your essentials.

Actions Now: Start. Start small; just start today. Procrastination is the number one enemy of wealth creation.

Inquire: The need to reassess your portfolio at intervals to ensure its alignment with your goals.

Thoughts: 2025: You and Prosperity Invest

Not just for the wealthy, any person who takes the first steps on this journey invests. With the right mindset, discipline, and opportunity, 2025 could be the very year when you turn your financial problems into a situation where you build a future.