In a rapidly changing economy, financial planning and advisory could be a crucial tool that individuals and organizations undertake to secure their long-term financial future. Whether preparing for retirement, managing your investment, or looking for ways to amass wealth, a well-designed financial plan is the heart of your success. This post takes a look at the basic elements of financial planning and advisory and provides you with insights and strategies for making your financial decisions.

Benefits of Financial Planning

Setting specific goals, evaluating your financial position at present, and putting measures to achieve them-that’s what financial planning is. Without a clearly defined plan, the most complex decision regarding money can be difficult to navigate. The benefits include:

1. Clarity and Direction:

Financial planning explains the nature of your earnings and expenses, as well as how much you can save and invest.

2. Risk Management:

Proper planning ensures that there exists some form of insurance and emergency funds that will offer protection in the case of an unexpected shock to your financial system.

3. Wealth Accumulation:

Financial planning facilitates wealth growth whereby planned short and long-term investment leads to increasing wealth along the way.

4. Retirement Preparedness:

Early planning secures your post-retirement lifestyle, allowing you to enjoy financial independence.

The Role of a Financial Advisor

A financial advisor is the professional who provides you with expert opinions and instructions based on your current situation. From investment planning to tax treatment, the expertise of an advisor aids the mission of your financial plan to be efficient and malleable. Services offered generally include:

- Portfolio Management: Design and maintain a diversified portfolio of investments.

- Tax Planning: Explore avenues to maximize income by subjecting you to taxes for a certain base.

- Estate Planning: Disposition of your assets should be according to your will.

- Debt Management: A strategy to efficiently minimize and manage debt.

Key Steps to Successful Financial Planning

1. Analyze Current Financial Situation:

Take a look at your income, expenses, debts and assets.

2. Define Goals:

Set both sharp short term and comparatively vague long-term objectives like getting a house, financing education or early retirement.

3. Create a Budget:

Assign your income toward fixed expenses, savings and discretionary expenses.

4. Invest Wisely:

Pick investments accordingly based on your preferences of risk and economic objectives. Diversification across the different classes of assets will lower your risks.

5. Review and Revise:

Analyze your financial plan periodically to buffer in life, changes and stock market variations.

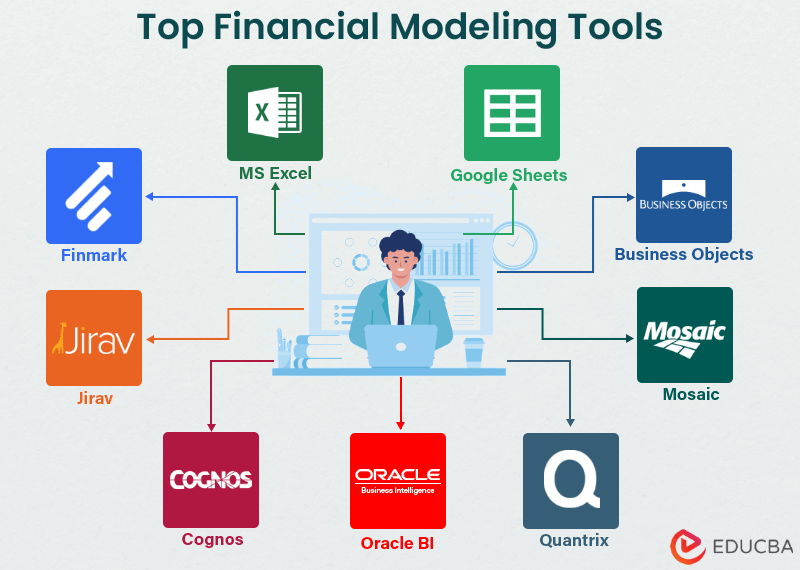

Key Financial Planning Tools

Modern technology provides an abundance of tools that aspiring planners can use to ease the task of financial planning. These include:

- Budgeting Applications: These help you record all your expenditures and savings.

- Investment Platforms: Diverse investment options are readily accessible.

- Retirement Calculators: Plan your retirement contribution and gauge how much you will have saved at a particular age.

- Tax Software: Appraise deductions and credits for the reduction of your liabilities.

Conclusion: Build a Strong Financial Future

Having the same meaning-with a good financial planning along with advisory services is not just to gather wealth, but to line it up with life goals. Being proactive and using an expert’s guidance can bring financial stability, growth opportunities, hence ensuring that you lead a good life ahead. Keeping in mind that financial planning is a journey and not a destination, seize this day to assure that you see a better tomorrow.